Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Find the solutions you need by accessing our extensive portfolio of information, analytics and expertise. The IHS Markit team of subject matter experts, analysts and consultants offers the actionable intelligence you need to make informed decisions.

Critical analysis and guidance spanning the world’s most important business issues.

Stay abreast of changes, new developments and trends in their industry.

A global team of industry-recognized experts contributes incisive and thought-provoking analysis.

Broaden your knowledge by attending IHS Markit events that feature our subject-matter experts. Find webinars, industry briefings, conferences, training and user groups.

During COVID-19, IHS Markit is offering more online events for the safety of our guests.

IHS Markit will resume our in-person events once it is safe to do so.

Missed an event or webinar? Review the recordings of past online events.

IHS Markit is the leading source of information and insight in critical areas that shape today’s business landscape. Customers around the world rely on us to address strategic and operational challenges.

The experts and leaders who set the course for IHS Markit and its thousands of colleagues around the world.

Sustainability drives the entire IHS Markit enterprise. It’s how we do business by guiding our values and culture on the notion that we can make a difference.

Join a global business leader that is dedicated to helping businesses make the right decisions. Be a part of a family of professionals who thrive in an exciting work environment.

The following is an extract from S&P Global Market Intelligence’s latest Week Ahead Economic Preview. For the full report, please click on the ‘Download Full Report’ link.

Download full report

Meeting minutes from the Fed and the RBA will be released in the coming week while Q2 GDP data for the Eurozone, Japan, Thailand, the Netherlands and Poland will be watched closely for updates on the macroeconomy. At the same time, industrial production performance will be eagerly anticipated for the largest two economies – the US and China – with retail sales figures also coming to light for the former. PMI data have indicated a general slowdown in growth as the economic environment faces headwinds from geopolitical uncertainty, high inflation and supply constraints. The week will end with sentiment and retail sales data for the UK.

Q2 GDP updates will flow thick and fast, with those for Japan and the Eurozone watched with particular interest. Japan registered a 0.1% contraction in Q1 with a 2.5% (QoQ) rebound anticipated for Q2. Meanwhile, in the Eurozone, GDP growth for is predicted to remain weak at 0.7% (Q1: 0.5%) as price pressures continue. Eurozone inflation data on Thursday is likely to confirm persistently high inflation.

The Fed FOMC minutes from the July 26-27 meeting will shed some light on whether the latest 75 basis point hike marked peak Fed hawkishness. Fed Chair Jay Powell is expected to slow the pace of interest rate hikes with data released last week indicating an easing in US inflation rates. Elsewhere, RBA meeting minutes will divulge reasoning behind last month’s 50 basis point hike.

Over in the UK, a series of key economic data will be assessed for the impact of the cost-of-living crisis, starting off with employment figures which are expected to remain relatively similar to those seen in recent months. Inflation data is projected to remain high on the back of June’s new 40-year peak of 9.4%. Sentiment and retail sales data at the end of the weak is expected to remain subdued and reflect the relatively bleak trading environment.

Finally, China industrial production data will unveil the extent of recovery following lockdowns during the second quarter. In the US, the manufacturing sector is expected to grow slightly following a 0.2% contraction in June.

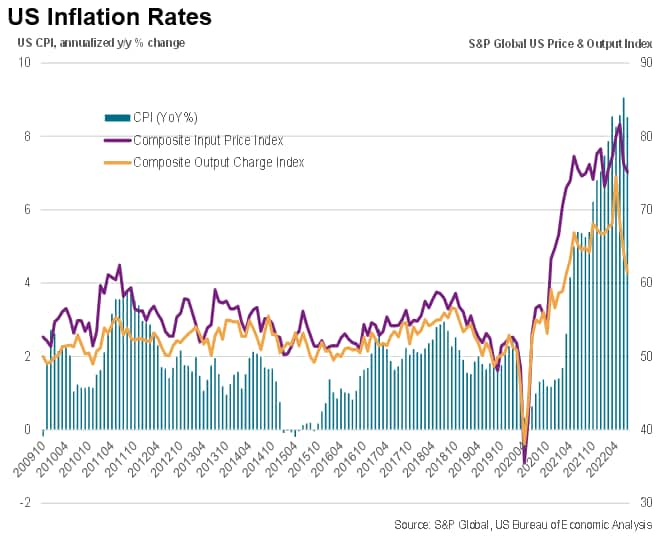

In line with the S&P Global PMI data, latest figures signaled cooling inflation rates across the US, with CPI rising by 8.5% year-on-year in July (down from 9.1% in June). This is primarily thanks to falling energy and petrol prices. Moreover, data suggests that inflation rates have already peaked, and market expectations suggest that upward pressures on prices will continue to ease in the second half of the year.

The recent numbers were welcomed by the Fed, stock markets and consumers alike. Nonetheless, inflation rates remain elevated and above the central bank’s target 2%. Reining back inflation will still be a concern for the Fed.

Additionally, the data provided by the US Bureau of Labor Statistics, highlights the resilience of the job market. More than 500,000 jobs were reported to have been added during July. This gives Fed the assurance and room to further continue tightening monetary policy. All in all, we expect further interest rate hikes, but perhaps a slower trajectory of incline compared to the vigorous 75 base point increases observed over the past two consecutive months.

Monday 15 August

Japan GDP Growth Annualized Prel (Q2) Industrial Production (Jun)

China House Price Index (Jul), Fixed Asset Investment (Jul), Industrial Production (Jul) Retail Sales (Jul)

Thailand GDP Growth Rate (Q2)

Indonesia Balance of Trade (Jul)

Brazil BCB Market Readout

United States NAHB Housing Market Index (Aug), Net Long-term TIC Flows (Jun)

Tuesday 16 August

Australia RBA Meeting Minutes

Japan Tertiary Industry Index (Jun)

United Kingdom Unemployment Rate (Jun), Employment Change (May), Average Earnings (Jun), Claimant Count Change (Jul)

India WPI Inflation (Jul), Balance of Trade (Jul)

Euro Area ZEW Economic Sentiment Index (Aug), Balance of Trade (Jun)

Germany ZEW Economic Sentiment Index (Aug)

Canada Core Inflation Rate (Jul)

United States Building Permits (Jul), Housing Starts (Jul), Industrial Production (Jul)

Wednesday 17 August

Japan Reuters Tank Index (Aug), Balance of Trade (Jul), Machinery Orders (Jul)

Australia Westpac Leading Index (Jul), Wage Price Index (Q2)

New Zealand RBNZ Interest Rate Decision

United Kingdom Inflation rate (Jul)

Netherlands GDP Growth Rate (Q2)

Poland GDP Growth Rate (Q2)

Euro Area GDP Growth Rate (Q2)

United States Retail Sales (Jul), Business Inventories (Jun), FOMC Minutes

Thursday 18 August

Japan Foreign Bond Investment (Aug)

Australia Employment Change (Jul), Unemployment Rate (Jul)

Netherlands Unemployment Rate (Jul)

Switzerland Balance of Trade (Jul)

Spain Balance of Trade (Jul)

Euro Area Inflation Rate (Jul)

United States Continuing Jobless Claims (Aug), Initial Jobless Claims (Aug)

New Zealand Balance of Trade (Jul)

Friday 19 August

United Kingdom Gfk Consumer Confidence (Aug), Retail Sales (Jul), Public Sector Net Borrowing (Jul)

Japan Inflation Rate (Jul)

Switzerland Industrial Production (Q2)

Poland Employment Growth (Jul)

Canada New Housing Price Index (Jul), Retail Sales (Jun)

Industrial production data for China and US

Industrial production data for China and the US will reveal manufacturing performance in the midst of China’s zero-COVID policy, surging inflation and weak demand. The latest Caixin China Manufacturing PMI signalled a slowdown in production growth as weak domestic and international demand weighed on performance.

Meanwhile in the US, industrial production is expected to grow by 0.2% (MoM) following June’s previous contraction. Latest PMI data indicated tough business conditions as the rising cost of living casted a cloud over performance.

Americas: US and Canada Retail Sales, US Jobless claims, Canada core inflation

A busy week for the US sees retail sales data in addition to jobs and industrial production releases. Retail sales figures are expected to remain weak as the cost of living increases rapidly. Inflation data last week pointed to a slowdown in price pressures, however.

Elsewhere, CPI data for Canada will be announced at the start of the week and will be watched closely. Attention will turn to retail sales data at the end of the week which will indicate how the sector performs in the midst of client hesitancy.

Europe: UK, Germany and Eurozone Sentiment and UK Inflation and Retail Sales

A plethora of economic data will be in the limelight for the UK this week with UK inflation data particularly scrutinised. The Bank of England predicts inflation peaking at 13% in October amid rising energy, borrowing and other costs. Subsequently, sentiment data is expected to remain weak following June and July’s record low.

In the Eurozone, GDP, inflation and sentiment data will be among the key releases this week. Like the UK, inflation figures are expected to remain elevated and even reach a new high in July while sentiment is predicted to remain deep in negative territory.

Asia-Pacific: India and Japan Inflation, China Retail Sales. RBNZ Interest Rate Decision

Japan Q2 GDP data will take centre stage in terms of APAC releases, though policymakers will also keep one eye on China to see how the governments zero-COVID policy has impacted growth. At the same time inflation data for India and Japan will be examined. At 2.3% in Japan, rates of inflation remain low compared to Europe, but still above target.

Another key event is the Reserve Bank of New Zealand’s interest rate decision. Policymakers are likely to employ another tightening given June’s 7.3% inflation figure.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Only 15% of US equity investors have raised their earnings expectations for Q3 2022 while 36% of respondents revise… https://t.co/pL1ijoiSa0

Healthcare stocks were the most favoured sector in August, with energy and IT following. Consumer discretionary and… https://t.co/mreiJxwFJE

The global macroeconomic environment, geopolitics and central bank policy are viewed as the biggest drags on the US… https://t.co/5l5pA4B9U8

US equity investors remain risk averse due to market headwinds from the increasingly gloomy global macroeconomic en… https://t.co/OLNG2Kzh2n