Search

Search

News

Covid-19

Lifestyle

Lifestyle News

Hot Deals

Trending

Drama

Things To Eat

Things To Do

Stories Of Us

Celebrity

Heartwarming

Travel

Videos

Abroad

Weekend

Environment

+ More

Parliament

Perspectives

History

GE2020

CareersSearch

News

Covid-19

Lifestyle

Lifestyle News

Hot Deals

Trending

Drama

Things To Eat

Things To Do

Stories Of Us

Celebrity

Heartwarming

Travel

Videos

Abroad

Weekend

Environment

+ More

Parliament

Perspectives

History

GE2020

CareersSearch

← Back

A bit of both.

| | ![]() June 18, 2022, 08:58 AM

June 18, 2022, 08:58 AM

![]() 25 June 2022

25 June 2022

![]() Golden Village VivoCity

Golden Village VivoCity

Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Follow us on Telegram for the latest updates: https://t.me/mothershipsg

The Selective En Bloc Redevelopment Scheme (SERS) is back in the news again.

“It does seem that people either think 1) you strike Toto by getting SERS, or 2) the government is gonna rob you by SERS-ing your block. There’s no in between,” observed a colleague.

So what is it actually? We reached out to the Housing and Development Board (HDB) for some answers.

What is SERS?

Launched in 1995, the Selective En Bloc Redevelopment Scheme (SERS) is used by the HDB to buy back flats in typically older estates.

This, says the HDB, allows the government to renew older housing estates where land use has not been optimised.

Homeowners whose flats come under SERS will be offered the chance to buy a home with a new 99-year lease at a subsidised price, compensation, and rehousing benefits.

What if I don’t want to take part in SERS?

There isn’t an “I” in SERS.

Individual homeowners have no say in the matter. Once your HDB block has been earmarked for SERS, it’s more or a less a guaranteed outcome that you cannot opt out of.

The Singapore government has the legal power, under the Land Acquisitions Act, to acquire your house (or any other property in Singapore, for that matter).

OK, you mentioned compensation?

HDB engages a professional private valuer to assess the market value of the affected flats at the time of the SERS announcement, and comes up with compensation.

The valuer takes into account the transacted prices of comparable resale flats nearby when determining the market value.

“Generally speaking, for flats with similar size, location and other attributes, older flats with shorter remaining lease would have a lower valuation than flats with a longer remaining lease,” HDB told Mothership.

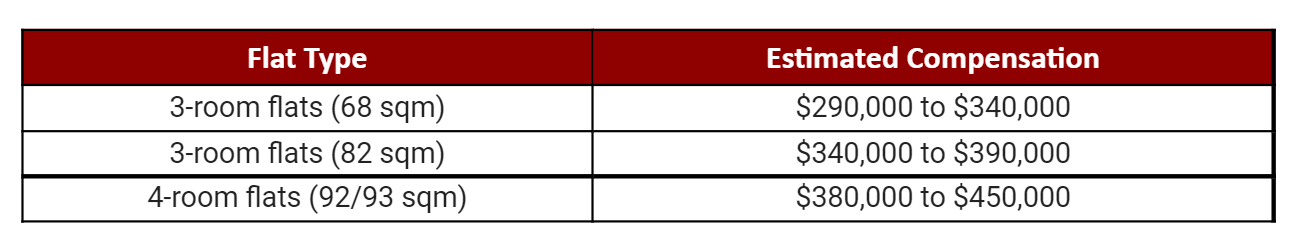

Here’s an example. For the latest round of SERS at Ang Mo Kio Avenue 3, HDB said that it shared with affected homeowners these estimated compensation amounts (the final amount will only be finalised later this year):

Homeowners will still need to deduct property tax, any outstanding housing loans, and refund amounts that were taken from their CPF (with accrued interest) before arriving at the final compensation amount that they will receive.

The HDB also covers some “reasonable expenses” to help homeowners defray the cost of moving.

For the affected homeowners at Ang Mo Kio Avenue 3, HDB is paying them a S$10,000 removal allowance, and covering the cost of stamp and legal fees for the purchase of a comparable replacement flat.

“The total amount ranges from an average of S$14,800 for a 3-room flat (68 sqm) to S$17,400 for a 4-room flat (92/93 sqm),” the agency elaborated.

If the Government buys my house, then where do I stay?

Homeowners have the option of buying new flats.

HDB offers newly-built replacement flats with fresh 99-year leases. HDB said that homeowners will “generally be able to purchase a replacement flat of a similar flat type with the compensation provided”.

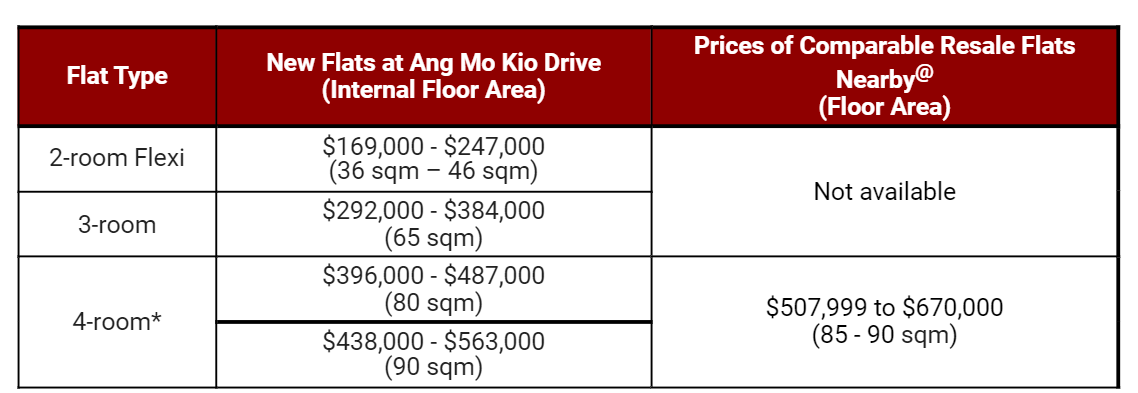

For the affected Ang Mo Kio Avenue 3 residents, this means that they should be able to get a similar-sized flat at no extra cost, at nearby Ang Mo Kio Drive.

HDB explained:

“In other words, existing owners of 3-room flats will be able to buy a new 3-room flat at the replacement site, while owners of 4-room flats will also be able to buy a new 4-room flat. Those looking for larger flat sizes or flats with better attributes may have to top up the amount. For example, there are two flat sizes for the 4-room flats on offer at Ang Mo Kio Drive, and those who wish to buy a larger 4-room flat may need to top up the amount.”

“In other words, existing owners of 3-room flats will be able to buy a new 3-room flat at the replacement site, while owners of 4-room flats will also be able to buy a new 4-room flat. Those looking for larger flat sizes or flats with better attributes may have to top up the amount. For example, there are two flat sizes for the 4-room flats on offer at Ang Mo Kio Drive, and those who wish to buy a larger 4-room flat may need to top up the amount.”

Those who take up HDB’s offer of a replacement flat can also have access to the SERS grant which can only be used to offset the cost of the flat. There are also other benefits, including waiver of fees, subsidised pricing of new flats, payment deferment, and concessions.

Estimated selling prices of the replacement flats offered to SERS homeowners. The final selling prices will be made known in late 2023, said HDB, Image courtesy of HDB.

Estimated selling prices of the replacement flats offered to SERS homeowners. The final selling prices will be made known in late 2023, said HDB, Image courtesy of HDB. There are other options for those who do not wish to buy a replacement flat.

They can apply for flats in a Build-To-Order (BTO) or Sale of Balance Flats (SBF) exercise, or open booking (and get priority allocation). The SERS rehousing benefits mentioned above also apply to these options.

If they do not wish to get a new flat, they can choose to receive an ex gratia (or, goodwill) payment of S$30,000 plus the SERS grant (if they fulfil the eligibility criteria) on top of the compensation.

So, windfall or trouble?

For some, getting selected for SERS is like winning the lottery.

After all, in land-scarce Singapore where HDB flat leases expire after 99 years, receiving a new flat with a new 99-year lease and better amenities (not to forget the potential to sell it on the resale market in future) is a perk that ranks up there.

Some buyers even seek out resale flats in mature estates, and consider a purchase of such a flat to be placing a bet in the “SERS jackpot”.

However, it’s not much of a jackpot for a specific group of people: Those who are not cash-rich, and have outstanding housing loans to repay or return.

Like these folks:

Those who are retired might also be less likely to secure a housing loan if they have to fork out extra money for a replacement flat. In such cases, they might have to downgrade to a smaller flat.

And then there are the intangible costs.

Residents in aging, mature estates that undergo SERS tend to be older or even retired. They tend to be less mobile and find it more difficult to get used to a new place. For these folks, being made to relocate places a strain on them.

Making elderly residents relocate places a strain on them. Image by Joshua Lee.

Making elderly residents relocate places a strain on them. Image by Joshua Lee. To alleviate such concerns, the HDB is offering a Joint Selection Scheme to homeowners in the Ang Mo Kio Avenue 3 SERS project. This scheme allows them to choose replacement flats with their neighbours so that they can continue living close to each other.

Still, SERS has its pros and cons. SERS tends to affect a whole housing cluster, which means hundreds of homes and homeowners, and it is perhaps unrealistic to expect that all will be happy. After all, we have seen multiple en bloc fiascos and legal battles involving neighbours who just didn’t want to move, despite all the money on the table.

HDB told Mothership that it is aware that some residents are concerned about topping up to buy a flat that is closer to the size of their existing flat.

“We understand these concerns, especially from seniors who have informed us that they do not need the fresh 99-year lease that comes with the new replacement flats. We are looking at the residents’ feedback and will continue to explore options to assist these families.”

“We understand these concerns, especially from seniors who have informed us that they do not need the fresh 99-year lease that comes with the new replacement flats. We are looking at the residents’ feedback and will continue to explore options to assist these families.”

What these options are — we don’t know as of now. Associate editor Chua Mui Hoong from The Straits Times suggested allowing flexible leases for SERS replacement flats, which can be especially useful for elderly residents.

In future, we also have other schemes like VERS — Voluntary Early Redevelopment Scheme (VERS) — which gives homeowners more autonomy over whether their homes will be sold back to the government, but also comes with its own set of drawbacks.

Perhaps these are the realities we have to contend with, living in land-scarce Singapore. For now, this is the government’s chosen methodology to tackle this very tricky situation of providing housing for everyone in land-scarce Singapore while having the option to redevelop land where needed.

Top image credit: Joshua Lee.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.

Kaypoh-ing Strangers: A man shares about his passion for dance and how he has always wanted to do it since he was a child.

![]() June 18, 2022, 10:57 AM

June 18, 2022, 10:57 AM

The man has been arrested.

![]() June 18, 2022, 12:04 AM

June 18, 2022, 12:04 AM

Bending over backwards for Beckham.

![]() June 17, 2022, 07:46 PM

June 17, 2022, 07:46 PM

People like to see a white guy eat their local delicacies and getting blown away.

![]() June 17, 2022, 07:11 PM

June 17, 2022, 07:11 PM

Farewell.

![]() June 17, 2022, 06:13 PM

June 17, 2022, 06:13 PM

"Void deck" on the fourth floor.

![]() June 17, 2022, 06:01 PM

June 17, 2022, 06:01 PM

Can you tell what fruits and vegetables these are?

![]() June 17, 2022, 05:41 PM

June 17, 2022, 05:41 PM

Stallholders have shared that their rent has remained unchanged.

![]() June 17, 2022, 05:12 PM

June 17, 2022, 05:12 PM

Similar to Minimum Occupancy Period (MOP) rules for HDB flats.

![]() June 17, 2022, 05:08 PM

June 17, 2022, 05:08 PM

The cat was well fed and not afraid of humans.

![]() June 17, 2022, 04:51 PM

June 17, 2022, 04:51 PM

About | Advertise with us | Contact us | We Are Hiring | Privacy policy

Copyright © 2020 Mothership. All rights reserved.